看法动态

REUTERS:WeWork launches China unit with $500 million funding from Hony, SoftBank

AddTime:2017-07-28

HONG KONG (Reuters) - Co-working space startup WeWork has set up a Chinese unit, with the help of a $500 million investment from China's Hony Capital and Japan's SoftBank Group Corp, to tap into a booming demand for shared office space in the world's No.2 economy.

The funds will be used to expand beyond WeWork's current locations in Beijing and Shanghai to at least five more large cities in the next six to 12 months, the New York-based firm's co-founder and CEO Adam Neumann said.

State-owned real estate developer Greenland Group and hospitality firm Jin Jiang International (Holdings) Co Ltd - parent of Shanghai Jin Jiang International Hotels Group - are also investing in the local unit, he said.

"By creating local entities we allow ourselves to take local management, give them local equity, incentivize them locally, operate the company under local law, respecting all the different cultures and the different rules that exist," Neumann told Reuters in an interview on Thursday.

The announcement follows a similar move unveiled earlier this month by WeWork to enter Japan's market with a 50:50 venture with SoftBank. The company will launch its first location in Tokyo in 2018.

WeWork, which provides shared office space for users such as entrepreneurs, freelancers and large corporations, operates more than 155 properties in 16 markets including the United States, its biggest market, Canada, Germany and China.

It is generating $1 billion a year in revenue at current rates and will launch an IPO in the future, Neuman has said. Its members pay on average $650 a month.

WeWork was valued at about $16.7 billion in a funding round last year, making it, according to Hony Capital, among the world's most valuable startups.

This year, in March, SoftBank invested $300 million in WeWork, the first tranche of a funding round that could total up to $3 billion, a source has told Reuters.

WeWork could unveil more units soon, CEO Neumann said, with SoftBank seen taking a stake in those businesses too. Having separate local entities in different countries gives WeWork the flexibility to take some of those units public, while keeping others under the parent, he added.

"We're not going to do too much, only in markets that are tremendously large, but in one or two more markets you're going to see us doing it, probably quite soon."

WeWork opened its first office in China in Shanghai in July 2016, expanding to four properties now, while in Beijing it has two spaces now. It also has two locations in Hong Kong. It is targeting more than ten properties in Greater China by end-2017.

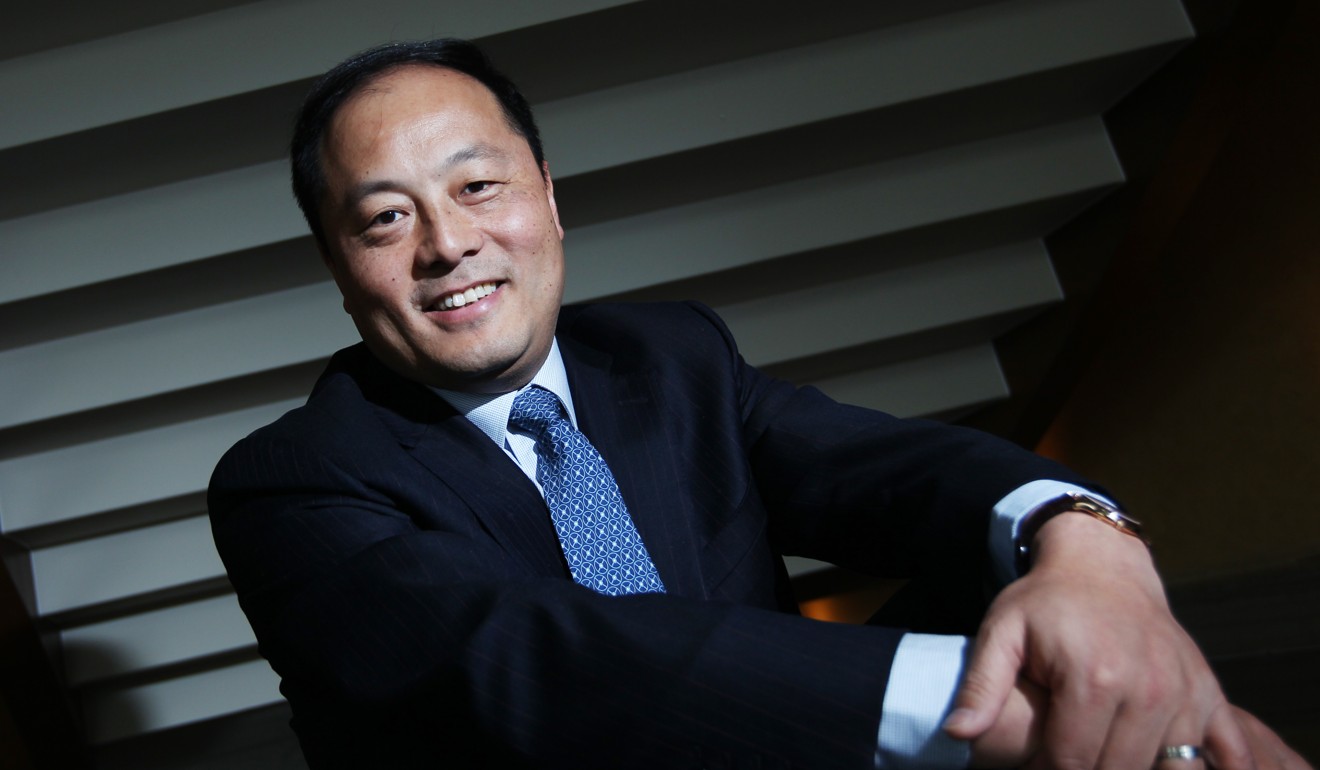

"In Shanghai, Beijing and Hong Kong, where WeWork opens an office, it will be filled up right away with high-quality membership and that gives us the confidence to accelerate the Chinese market development," John Zhao, Hony Capital's founder and CEO, told Reuters.